Market Insiders Pick up Interest in INTC

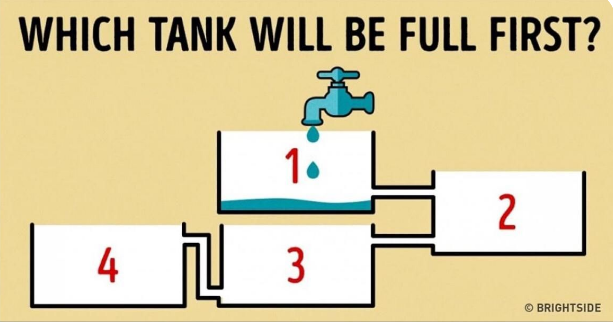

Here’s a puzzle to start your day…

Maybe you’ve seen this before. Even if you haven’t, you’re probably smart enough to avoid the trap of thinking Tank 1 will fill up just because it’s first. It’s easy to see Tank 1 will overflow into Tank 2, which will flow into Tank 3, which eventually overflows into Tank 4.

It is easy to see, that is, if you have the whole picture.

Unlike this puzzle, markets don’t give you the whole picture of what’s exactly going on. Investors see a stock “filling up” and they rush to throw their money at it — assuming it will be the first to fill up.

But the in-the-know insiders — which our QIT-4 indicator keeps close track of — are working with the whole picture, or close to it. So this week’s Profit Wire pick could be our proverbial Tank 3 (did you get the right answer?) in the race for artificial intelligence hardware.

The company lighting up on our proprietary indicator this week is the chipmaker Intel Corp. (INTC).

Intel has been a distant third horse in the race for semiconductor supremacy — which as you likely know has become a white-hot market since ChatGPT made AI “a thing” late last year.

Nvidia’s share price has tripled since then — making it the clear Tank 1 in our puzzle metaphor. NVDA has found historic success selling its superpowered H100 graphics processors to companies developing complex AI programs. Coming off of a second straight earnings report that blew expectations out of the water, its success is limited only by its ability to supply a seemingly infinite demand.

That’s where our Tank 2 — Advanced Micro Devices — starts to see the water come pouring in. Despite playing catch-up to Nvidia, AMD has seen its share price climb over 70% since last November with ChatGPT’s public release.

Then there’s Intel — still the perennial revenue leader among American semiconductor manufacturers. But it’s gotten only a tiny sliver of the AI pie with a meager 8% bump to the share price post-ChatGPT.

People certainly haven’t forgotten about Intel. In fact it’s been getting plenty of negative publicity because it can’t keep pace with Nvidia and AMD. Well, and because it’s been operating at a loss — with 12-month operating income of minus $3.8 billion.

After Intel tried and failed to return to the graphics-card market after a decades-long hiatus… Wall Street analyst Jon Peddie went so far to suggest that Intel drop its accelerated computing branch and focus only on data-centers and AI…

“AMD and Nvidia have brought out three generations of new and stunningly powerful dGPUs, and more are in the pipeline. Four new companies have started up in China, and two new ones announced in the U.S. Intel is now facing a much stronger AMD and Nvidia, plus six startups — the rules of engagement have dramatically changed while Intel sunk money into projects it can’t seem to get off the ground.”

Nor do Intel’s woes end there. There’s the U.S.-China chip war. Beijing denied approval for INTC to take over Israeli-based Tower Semiconductor — killing a $5.4 billion acquisition.

Intel is certainly bruised and falling far behind in what’s become the highest-stakes game in the market. But in-the-know insiders don’t seem to think they’re beaten yet.

With a deluge of demand overflowing from one tank into the next, there are still plenty of winners left to pick — and the QIT-4 indicator seems to have detected something big here. Keep reading for Alan’s step-by-step trade instructions — so you can take advantage before the money starts pouring in.

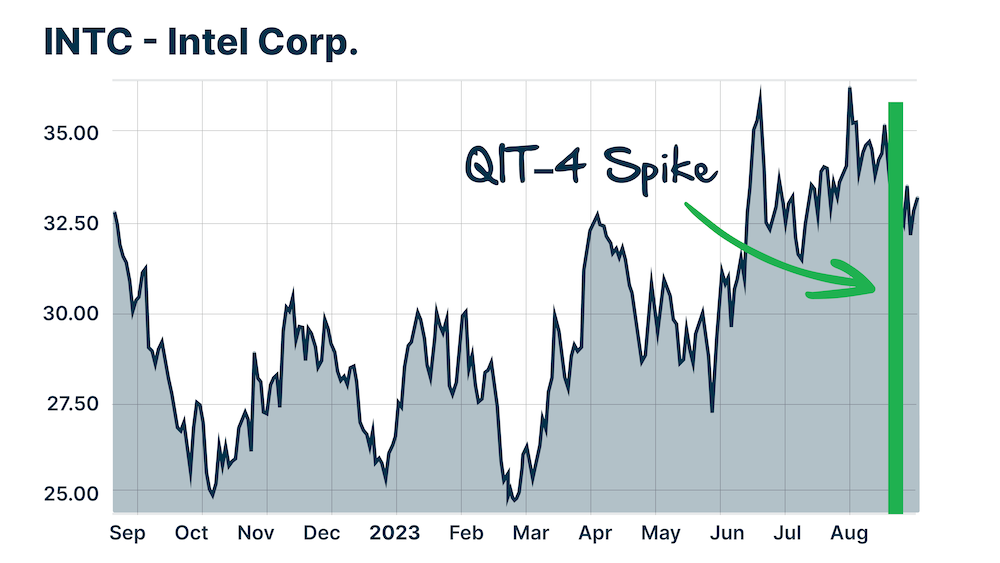

QIT-4 Spikes on INTC!

Intel Corp. (INTC) is an American multinational corporation and technology company headquartered in Santa Clara, California and is one of the world's largest semiconductor chip manufacturers by revenue.

And today, the QIT-4 is spiking on a high volume of bullish options activity behind the scenes...

Take a look for yourself!

As you know, the QIT-4 cuts through millions of historical data points to pinpoint the real story on Wall Street… it can see potential catalysts that have yet to hit the news!

It’s not uncommon for our indicator to highlight companies at their darkest hours. However, this time, there’s a lot to be excited about when it comes to Intel on a technical level…

Even with market action aside, our proprietary QIT-4 indicator is telling us that INTC is looking to heat up even more… By revealing the influx of leveraged call option buying going on behind the scenes, especially purchases from smart-money insiders, it’s likely that they know something we don’t and are putting their money up on that hunch.

That being said, there could be a big catalyst event right around the corner, one that could send this stock rallying much higher!

So today, we're going to follow the smart money and put ourselves in a position to profit from an INTC rally!

Let’s take a closer look…

The Bottom Line for INTC

When looking at INTC’s chart, we’re actually seeing a different story than we do with some of our Profit Wire plays.

You see, there’s a lot of reason to be excited about Intel’s stock from a technical trading perspective. For starters, there’s already a solid uptrend building right now. After two rally attempts in November and February, Intel’s stock price sank. Then, in the spring of this year, Intel was able to find its footing and push past the resistance it had trouble with previously.

Zooming out a little more, Intel has been trading in a range between $25 and $35 for about a year now. With its stock price rapidly approaching the top of that range, a breakout above $35 would target a move to $45.

Even better yet, INTC has a gap to fill up toward its August high of $37. This provides even more momentum for Intel to break above that $35 resistance.

And speaking of momentum, let’s not forget that we have the QIT-4 showing us that there’s plenty of smart money flowing into this company right now…

With a big rush of option purchasing, these smart-money insiders could be getting in position ahead of a major news event that could send this name trading higher. As for us, all we have to do is follow alongside the smart money and we’ll be in a great position for gains!

But we have to move fast. Here’s how we’re going to buy in before the rest of the market catches on…

QIT-4 Stock Recommendation:

Buy shares of Intel Corp. (INTC) using a limit of $35.

This is the least risky way to play this opportunity and offers an unlimited amount of time for you to book a big gain.

The downside is that your potential gains are much smaller than what you could see by investing with a more aggressive strategy.

That being said, it’s still possible to see better returns than the average investor, which is why we recommend this play if you are risk-averse.

Our long-term price target for the stock is $45, which is about 28% higher than the suggested limit price of $35. We may recommend selling below that price to lock in profits.

Want More The Profit Wire?

Do you like this content? Would you like to know more? Because we have this and much more to share with you. Get started today!