Why “Nvidia Math” Is Going To Make Us Rich

This could be the best spot to get into AI stocks in years.

And if you've been waiting on the sidelines, this might be your last chance to get in before the next massive leg up.

AI names have traded way lower this year.

Advanced Micro Devices (AMD) is down 42% from last year’s all time highs.

Dell Technologies (DELL)? Almost cut in half, down 45%.

Even the mighty Nvidia Corp (NVDA) is down 21% from last year’s all time highs.

Investors have been worrying that the AI boom might be cooling, and that worry has shown up in AI hardware companies going lower.

But Nvidia's GTC conference yesterday turned that fear upside down in spectacular fashion.

This is exactly what James talked about in Austin last week during our Tech Turning Point 2025 event.

He said AI is a transformative technology that's rapidly evolving and creating significant investing opportunities.

And guess what? He’s right.

If you've been holding NVDA or other AI stocks through recent volatility, yesterday was your vindication moment.

We have a unique opportunity right now.

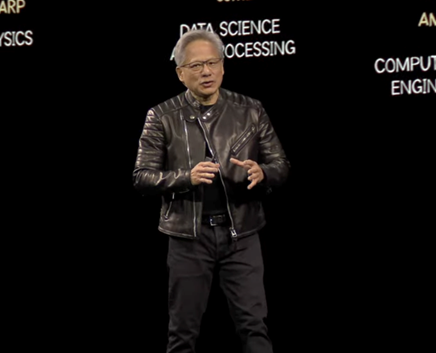

Nvidia CEO Jensen Huang was on stage yesterday in his trademark leather jacket. And he revealed something that changes everything about AI investing…

The computational demands of next-generation AI are going to be much, much greater than what anyone anticipated just a year ago.

"The amount of computation we need is easily a hundred times more than we thought we needed this time last year," he said.

This isn't just another product announcement or incremental upgrade. This is Nvidia essentially saying: "That massive AI build-out you thought was happening? Multiply it by 100."

That’s Nvidia math!

The Reasoning Revolution

So what's driving this massive increase in demand?

It's what Jensen calls "reasoning AI" – artificial intelligence that doesn't just blurt out an answer based on pattern matching, but actually works through problems step by step.

In one demonstration, Nvidia showed how a traditional AI could solve a complex problem using 439 "tokens" (the building blocks of AI responses). The answer came quickly but was wrong.

The new reasoning AI took nearly 9,000 tokens to solve the same problem – it tested different approaches, checked its answers, and arrived at the correct solution. But it required 20X more processing power.

This shift to reasoning AI is transforming the entire industry. Think of it as the difference between a calculator and a mathematician.

A calculator gives instant answers but can only handle what it's been programmed for. A mathematician takes longer but can tackle novel, complex problems.

Beyond GPU Shortages

For investors, this has massive implications.

First, remember all the talk about GPU shortages ending? Forget it. We're entering a new phase of AI that will drive unprecedented demand for computing power.

Second, Nvidia isn't just upgrading its chips – it's completely reimagining how AI computing works. Their new Blackwell system delivers 25X more performance than its predecessor using the same amount of power.

Remember when Nvidia’s Hopper GPUs were the hot stuff?

Jensen openly mocked his own previous generation hardware, saying "when Blackwell starts shipping in volume, you couldn't give Hoppers away."

That's how fast the technology is advancing.

"Nvidia Math" Changes Everything

Nvidia has become so dominant that they're literally changing how the industry measures computing power. They're measuring differently, counting differently, and building differently – all to support the massive scale needed for this new generation of AI.

The company unveiled a roadmap through 2027 showing each generation providing exponentially more power, culminating in systems 900 times more powerful than today's top chips.

Perhaps most significant for investors: Nvidia is no longer talking about data centers, but "AI factories."

These aren't traditional facilities – they're specialized buildings designed from the ground up to generate AI tokens. Jensen projects that AI factory build-out will reach $1 trillion soon, creating enormous opportunities across the entire supply chain.

From liquid cooling systems to specialized integration services, from new memory technologies to advanced silicon – the entire ecosystem is being transformed.

This isn't just another chip cycle. It's the beginning of what will likely be the defining wealth-creation opportunity of our lifetime.

When something you want goes on sale, you buy.

Right now, AI is on sale.

Wall Street is still catching up to what this means. But for those who understand the implications, the opportunity has never been clearer.

Want More Altucher's Investment Network?

Do you like this content? Would you like to know more? Because we have this and much more to share with you. Get started today!