The Gucci Bowl

If I learned anything watching the game last night, it’s that too many people still have too much money to burn.

But it actually proves a point that our Zach Scheidt made in last week’s editorial meeting.

He doesn’t think you should waste any time envying the rich.

Instead, you should invest in stocks that benefit from their extravagant lifestyles.

I’ll tell you where he’s looking in a second.

Before we get to that, however, let’s take a look at our Top Stories and the Reader Forum.

Your Top Stories & Analysis of the Week:

- “Tucker Is No Duranty'' (Daily Reckoning, Sean Ring): Tucker Carlson is being criticized for his recent interview of Russian leader Vladimir Putin. But as Sean explains, that’s only because people have forgotten what bad journalism really looks like. He recounts the story of Walter Duranty, a former Moscow bureau chief for The New York Times. While Duranty won a Pulitzer prize for his Russia stories, he also downplayed Stalin’s atrocities... essentially letting him get away with murder. Member John H. nominated this write-up for Story of the Week — and it’s not hard to see why!

- “The Sovereign Developer” (Altucher Confidential, Chris Campbell): Sean nominated this story for another one of our top spots. Chris reports from Vitalia in Prospera, Honduras, a “pop-up” city devoted to the science of extending human lives. It might seem like an odd place to expect scientific advancement. But as Chris explains, it’s actually the dawn of a new way of thinking about innovation, entrepreneurial spirit and more!

- “Here’s Why You Should Own Royalty Companies” (Lifetime Income Report, Byron King): It’s setting up to be a good year for precious metals. And while owning physical coins and bars is great, you could also set yourself up for capital gains and ever-higher dividends with royalty companies. Byron recently told Lifetime Income Report members exactly how they work — and even named a few of his favorites. I decided to unlock an excerpt of his article so you have a chance to benefit from his wisdom, too.

Remember, we publish tens to HUNDREDS of stories. The write-ups and presentations above are our TOP ones for the week — including one that had been roped off from the public. If you want to stay ahead of the pack, make sure you’re caught up now.

And if you’d like to nominate any of our stories for next week’s “Top 3,” just let me know at concierge@paradigmpressgroup.com.

The Reader Forum:

First from the mailbag today, Lawrence B. tells us about his recent interaction with a member of my team:

I was very pleased with Lori. She was able to go slow, step-by-step, to help me locate the reports I needed. If it wasn’t for your wonderful customer service team, I would not be able to continue my memberships. Thank you for all you do!

Lawrence, this is music to my ears! As I’ve said many times before, we try to treat all of our members like family. So I’m glad to hear Lori lived up to expectations. I look forward to sharing this with her.

Next, Victoria K. recently signed up for The Trading Desk and wants Greg Guenthner to know she is:

So very pleased to be a part of [the] Trading Desk community and truly appreciate your kindness.

Welcome, Victoria! The Trading Desk is truly unlike any other service we offer. It sounds like you’ve enjoyed everything you’ve experienced so far. And we wish you much success!

Finally for today, while we’re encouraged by the compliments we receive, I’m also happy to answer your questions whenever I can.

And during Friday’s Rickards Uncensored broadcast, Dennis O. asked:

I'm having difficulty isolating certain emails that recommend specific stocks I should purchase. Any advice?

I hope you’re reading this, Dennis! Our team really can’t answer questions like this during the live broadcast… which is another reason why this Concierge Letter and the Reader Forum is so important.

But the best place to find the content you’re looking for is the Message Center on our website.

Just click the envelope icon on our homepage to see every issue, alert, report and more we’ve posted for all of your services.

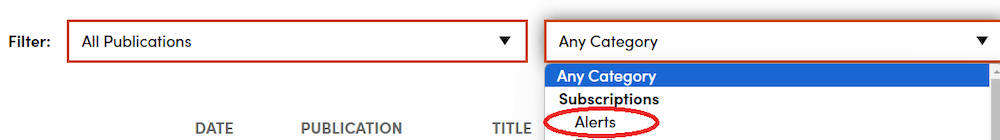

Filter the results under “Any Category” to show just the Alerts or Issues. It’s where you’ll find all of our actionable recommendations.

Everything you need is right at your fingertips!

That wraps up this week’s Reader Forum.

Remember, your feedback is vital to our success… so please email me at concierge@paradigmpressgroup.com.

Questions? I’ll get answers! Comments? Let me hear them! Problems? I’ll try to solve them!

This is YOUR forum!

(And remember, for customer service issues, use our contact page.)

Now, here’s what’s happening around the water cooler this week…

The Water Cooler — Upcoming Events and More

There’s a good chance you watched the Super Bowl last night… but probably not live in the stadium.

StubHub says the average ticket price was $8,400!

Frankly, I can’t imagine dropping that kind of money for a few hours of entertainment.

And that’s to say nothing of getting to and from Las Vegas, with a hotel to boot.

It may as well have been the Gucci Bowl…

Yet the stadium looked completely full to me!

Consider it yet more proof that plenty of people are still very flush with cash — and aren’t afraid to spend it lavishly.

Zach, our trading, income and retirement specialist, actually brought this up during last week’s editorial meeting.

“Baseline consumers are still struggling from inflation,” he says. “Prices have fallen, but people are still in as much pain as before.”

That’s not true at the higher echelons of society, where the rising stock market just gives the well-off even more incentives to spend.

“This level of consumer is doing fine,” he says.

The Super Bowl is just one example of the kind of thing they’re willing to drop a fortune on.

Last week, Walt Disney Co. (DIS) reported record income and revenue from its theme parks around the world.

“The well-off want experiences,” Zach concludes.

That’s why he’s taking a close look at cruise companies, like Royal Caribbean Cruises Ltd. (RCL).

It’s a way for you to profit while the rich play.

“Regular families out there are struggling,” Zach admits. “But by making these kinds of investments, they can benefit from the people who are doing fine.”