Avoid These Small-Cap Traps

Obviously the big news this morning is that Joe Biden has dropped out of the presidential race… exactly as Jim Rickards predicted in October 2023.

Jim will have an update today, as will other members of our team. (Get Sean Ring’s take right here.)

We’ll also have to see how this news affects Wall Street.

Last week, we finally started seeing a rotation out of the giant tech stocks into smaller, under-the-radar names. And this weekend’s news could add jet fuel to the opportunity.

Our team thinks it could lead to massive profits as small- and micro-cap stocks take off…

But only if you avoid some easy mistakes.

In a second, I’ll tell you the worst ways to try to cash in on the coming small-cap boom. And I’ll share what you should do instead.

First, though, let’s take a look at our Top Stories and the Reader Forum.

Your Top Stories & Analysis of the Week:

- “The Trump adVance Continues” (Rude Awakening, Sean Ring): Just about all of our most-liked stories last week involved the Trump assassination attempt. We had thoughts from Jim Rickards, Dave Gonigam, Chris Campbell and others. Sean also weighed in with a pair of essays on the subject. But a member of our team says that Sean’s profile of vice-presidential candidate J.D. Vance is just as important. See why Sean thinks the Hillbilly Elegy author and Ohio Senator is the best man for the job.

- “The Rotation Is Real!” (Morning Reckoning, Greg Guenthner): The major indexes fell last week as investors moved out of the giant tech stocks and into smaller opportunities. Greg has been watching for this pattern to emerge. Now that it’s here, he walks you through the charts and reveals where you’ll find the next “hot money” trade. Discover why small-cap and microcap stocks are set to outpace Wall Street’s biggest names. (And see today’s Water Cooler below for more on small-cap opportunities.)

- “If the Lights Go Out” (Jim Rickards’ Strategic Intelligence Pro, Jim Rickards): Some Texans spent more than a week without electricity in the wake of Hurricane Beryl. And last week a software glitch caused chaos at airlines, hospitals, emergency services and more around the globe. Imagine if the problems had affected U.S. power plants! In the latest “Crisis Survival Insider” alert for Strategic Intelligence Pro readers, Jim shares some simple and practical steps you can take to be ready for a prolonged blackout. Ray Blanco calls it “great advice.” And considering how vulnerable our electrical grid could be, I’m unlocking Jim’s insights so you can stay safe, too!

Remember, we publish tens to HUNDREDS of stories. The write-ups and presentations above are our TOP ones for the week — including one that had been roped off from the public. If you want to stay ahead of the pack, make sure you’re caught up now.

And if you’d like to nominate any of our stories for next week’s “Top 3,” just let me know at concierge@paradigmpressgroup.com.

The Reader Forum:

First in the Reader Forum today, Rachel H. has a message for Jim Rickards:

Thanks for all the great work you all do! I get far more useful advice from Jim Rickards and his team than everything else put together.

I hope you’re reading this, Rachel, because I want to thank you for your support!

We strive hard to bring you insights, analysis and recommendations you won’t find anywhere else. So it’s great to hear that you value the fruits of our labor.

I’ll make sure Jim and his team see your kind words.

Next, Omega Wealth Circle member Geoffrey B. left us a five-star Google review, adding:

The only downside is that I can ONLY give you 5 stars rather than the 10 stars you deserve!

I hope that means the Omega Wealth Circle has provided double your expectations, Geoffry!

And if you’re reading this, thanks for joining our highest level of service. It sounds like you’re enjoying your unlimited access to everything we offer!

But I especially want to thank you for posting a review that everyone can see. As I’ve often said, we don’t have deep-pocketed Wall Street firms paying us advertising money to push their preferred narratives.

So we really appreciate any word-of-mouth that helps us reach new people.

And finally for today, David B. writes to Ray Blanco to say:

It is very sketchy that a company trying to entice people would not provide a way out of emails. Why would you not give them the option to Unsubscribe, as almost all REPUTABLE companies do?

David, if there’s anything I take more seriously than scam accusations — like I covered in last week’s Reader Forum — it’s claims that we’re disreputable.

All of our e-letters and promotional mailings have a one-click unsubscribe button at the very top.

Click it once, and that’s it — we’ll remove your address from our mailing list.

Now, it’s true we don’t offer the same one-click unsubscribe button on our paid emails.

Unsubscribing to Ray’s emails would mean missing vital buy and sell alerts that you’re paying for.

For example, without email, you might have missed Friday’s Technology Profits Confidential recommendation to sell your Sarepta Therapeutics (SRPT) shares for a 35% gain in less than a year.

Imagine if you could accidentally stop these paid emails with a single click. Would a reputable company blindly stop sending you bought-and-paid-for analysis and recommendations?

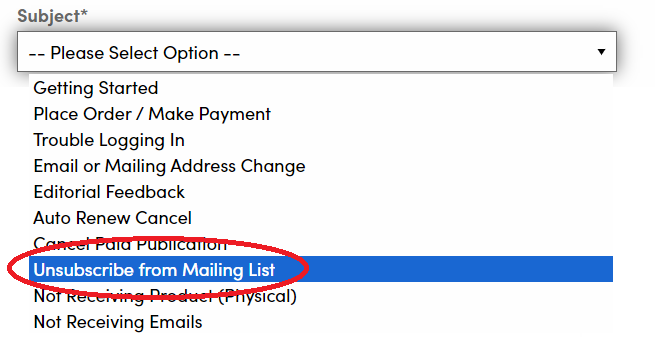

Still, if for some reason you don’t want to receive Ray’s absolute latest actions to take, it’s easy to take care of. Just go to our online Help Center and select “Unsubscribe to Mailing List” under “Subject.”

It’s more than a single click, but we want to be absolutely sure you don’t want to get your money’s worth from your membership.

That wraps up this week’s Reader Forum.

Remember, your feedback is vital to our success… so please email me at concierge@paradigmpressgroup.com.

Questions? I’ll get answers! Comments? Let me hear them! Problems? I’ll try to solve them!

This is YOUR forum!

(And don’t forget, we also have a FREE library of introductory investment guides on our Wealth Desk. For customer service issues, please use our contact page.)

Now, here’s what’s happening around the water cooler this week…

The Water Cooler — Upcoming Events and More

There are many ways to describe how big a company is. Wall Street’s favorite measuring stick is known as market capitalization — or market cap, for short.

It’s simply the number of stock shares a company has issued multiplied by the price of each share.

Lately, all of Wall Street’s attention has been focused on stocks with the biggest market caps. Names like Apple Inc. (AAPL), with its $3.4 trillion market cap… or Nvidia Corp. (NVDA), with a market cap of $2.9 trillion.

And until recently, companies on the small- and microcap side of the market — with market caps under $200 billion — have been left alone.

But last week, investors suddenly realized that Wall Street’s tiniest stocks were selling at bargain prices.

Our team thinks it’s just the start of a movement that will push small- and microcaps to incredible heights.

“Small caps have been a mess for months,” says Greg Guenthner. But “we’re finally seeing key breakouts emerge in some forgotten corners of the market.”

“Small-cap innovators could quickly pick up momentum,” Ray Blanco tells us.

“A lot of ignored small-cap stocks are good values,” says Dan Amoss.

You might think the best way to play this coming move is with an exchange-traded index fund like the iShares Russell 2000 ETF (IWM). It’s designed to mimic the performance of the Russell 2000 index of small-cap stocks.

But an index fund doesn’t judge whether the companies it’s holding are good or bad. And Zach Scheidt and Dan say the Russell 2000 is overweight in several worrisome industries, like regional banking.

“Regional banks have the most exposure to commercial real estate,” Dan reports. “A lot of them are losing money.”

The losers in an index fund drag down the gains you get from winners.

Another strategy is to simply buy a basket of individual small-cap stocks on your own. Shares tend to be inexpensive, meaning you could build a diversified portfolio for very little money.

The problem is that a lot of these companies are tiny for a reason — they lack the ability to grow or survive.

Putting these inevitable losers in your portfolio will soak up cash you could have invested in more promising opportunities. And they’ll also weigh down the profits you’ll see from your winners.

The best strategy, according to Zach, is to buy good companies that will benefit from Wall Street’s move out of mega-cap stocks.

That means companies with lots of cash, little debt, significant revenue and huge growth potential.

Following these guidelines will help ensure you make more than index fund investors or anyone who uses a blind shotgun approach to small-cap investing!