Welcome to “Nvidia Valley”

$1.4 million in 10 years.

That’s how much you’d be sitting on today if you had invested $5,000 in Nvidia Corp. (NVDA) back in 2014 and recycled your dividends.

NVDA’s moonshot gains are probably behind us now… but you could still score similar profits from the company indirectly.

That’s because our team believes Nvidia is about to go on a spending spree in the new tech capital of the United States.

It’s not Silicon Valley. In fact, it’s on the other side of the country.

Nvidia’s management has already established partnerships in the region. And it could easily move to set up permanent roots — creating fresh moonshot opportunities in its wake.

Our team is just starting to dig into this story… but I’ll give you a sneak peek at what they’ve uncovered so far.

Before we get to that, though, let’s look at our Top Stories and the Reader Forum.

Your Top Stories & Analysis of the Week:

- “A Speculator’s Paradise Turns Sour” (Morning Reckoning, Greg Guenthner): Nvidia’s 10-for-1 stock split helped spark another buying frenzy. Now there’s speculation that the tech giant will be added to the Dow Jones Industrial Average… which would force index funds to pick up shares. Greg considers whether the stock’s epic run can continue — and shares some sage advice that can help you find long-term trading success. (And see today’s Water Cooler for some insights into Nvidia’s next move.)

- “$154K ETH” (Altucher Confidential, Chris Campbell): Supply shortages have created some of history’s biggest profit opportunities. And Chris tells us that one is developing in cryptocurrency Ethereum. In fact, VanEck predicts it could cause Etherum’s value to skyrocket. Chris explains exactly what’s happening to the crypto… and shares three ways to take advantage of it. This was our most-liked e-letter last week, so don’t miss it!

- “Apple Throws Gasoline on the AI Arms Race” (Altucher’s Investment Network, James Altucher): Last week, Apple Inc. (AAPL) finally announced its plans to integrate AI into its major products. So James Altucher walked his Investment Network readers through Apple’s upcoming innovations. He also explains why they’ll create a brand-new AI spending spree — essentially forcing its competitors to advance the technology. This was our most-liked story of the week… and sets the foundation for some major stories to come. So I’m happy to unlock James’ analysis for you.

Remember, we publish tens to HUNDREDS of stories. The write-ups and presentations above are our TOP ones for the week — including one that had been roped off from the public. If you want to stay ahead of the pack, make sure you’re caught up now.

And if you’d like to nominate any of our stories for next week’s “Top 3,” just let me know at concierge@paradigmpressgroup.com.

The Reader Forum:

Last week I asked for your opinion of Keith Gill, the “Roaring Kitty” who profits from stocks that Wall Street’s elite have bet against.

Daniel A. tells us:

Our governments and global elite have been picking winners and losers unfairly… It should be totally fair for groups of people to communicate publicly their opinions and act according to that information. I am totally against shorts who attack weaker, smaller companies trying to get started or get their feet under them and become stable companies. If they are allowed to attack companies, why can't others defend them equally?

Thanks for responding, Daniel! I agree that too many powerful people have their thumbs on Wall Street’s scale. So you need sources of independent analysis and research to even the odds.

But our team would argue that Roaring Kitty isn’t championing companies that deserve a second chance.

AMC Entertainment Holdings Inc. (AMC) and GameStop Corp. (GME) knew their markets were changing, but didn’t make any adjustments to their business models. They still haven’t, even though Gill and his followers have sent their share prices higher.

Should everyday investors be encouraged to prop up companies with grim outlooks? What will happen if they end up losing their shirts?

I don’t have the answers… but we’ll keep trying to figure it out!

Next from the mailbag — in last week’s Reader Forum, Bill D. said “Jim [Rickards] is way far out into conspiracy orbit.” That inspired Steve S. to respond:

Sometimes I, too, get the heebie-jeebies following Jim's warnings. However, I believe Jim's experience far outweighs my lifetime's insights, and as glaring as some of the articles I read are, they still draw me to the conclusion that Jim's communications are presented in a way to prepare us for worst-case scenarios.

That’s a great attitude to have, Steve. Let’s be honest — no one likes to think about what could go wrong. Wall Street is ignoring every red flag and just keeps driving stocks higher.

But you can be sure that hedge funds and the elite have contingency plans for a downturn. So it’s the ordinary investors who are set to lose the most if things turn sour.

Jim is doing everything he can to prevent that, however. Where members like Bill D. see fear-mongering, we see useful warnings that can help you protect and grow your wealth.

Because eventually, Jim’s predictions will prove correct. And it’s better to be prepared too soon than too late!

Finally for today, William H. used The Trading Desk’s Live chat to ask Greg Guenthner:

Do you have an agreement with the other editors not to pick the same stocks? I don't recall seeing "cross pollination" on the tickers.

You’re not the only one who wonders that, William. So even though Greg addressed this in the chat, I hope you don’t mind me sharing my answer here.

Each of our analysts has their own criteria and methods for finding new recommendations. They also pitch ideas to each other, getting thoughts and feedback on plays they’re looking at.

For the most part, though, no one says, “you can’t recommend that because I want to recommend it.”

The only exceptions are with smaller stocks. If someone says to buy a thinly traded stock that’s already in another portfolio, the price could artificially surge.

Outside of that specific scenario, though, we don’t forbid our team from recommending a stock or option just because it’s in another portfolio.

In fact, there have been plenty of companies recommended by multiple services. We’ve even had cases where our analysts took completely opposite positions on a stock.

The point is, our team prides itself on its independence. So you can be sure they always share their absolute best recommendations — regardless of what’s happening in other services.

That wraps up this week’s Reader Forum.

Remember, your feedback is vital to our success… so please email me at concierge@paradigmpressgroup.com.

Questions? I’ll get answers! Comments? Let me hear them! Problems? I’ll try to solve them!

This is YOUR forum!

(And don’t forget, we also have a FREE library of introductory investment guides on our Wealth Desk. For customer service issues, please use our contact page.)

Now, here’s what’s happening around the water cooler this week…

The Water Cooler — Upcoming Events and More

Yep! Had you invested $5,000 in Nvidia in 2014, you’d be sitting on over $1.4mm today.

Plus, Nvidia continues to be Wall Street’s hottest stock — hitting new high after new high.

But can the company continue living up to investors’ expectations?

We’ve talked about how tenuous Nvidia’s grip on artificial intelligence (AI) is.

Its days of charging clients top-dollar will slowly fade away as alternatives become available.

According to our Ari Goldschmidt, Microsoft Inc. (MSFT), Facebook’s Meta Platforms (META) and Google parent Alphabet Inc. (GOOG) are all developing their own AI chips.

So if Nvidia CEO Jensen Huang is as smart as our team thinks he is, he’ll look to pivot the company into another area it can dominate.

With all of the money it’s raking in, Nvidia could easily buy up other businesses in a related space.

One strong possibility is cloud computing — which allows people to use advanced software applications with few hardware restrictions. That’s because the bulk of the programming is stored “off-site” at a data center.

Right now Nvidia rents data center space from other companies. But if Nvidia is looking to innovate another technology, it could simply acquire a few of the middle men.

And it would most likely start in Virginia.

The state is home to the largest concentration of data centers in the United States — possibly the world. And it continues to grow.

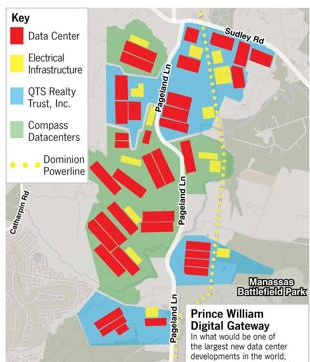

Virginia’s Loudoun County is already home to 30 million square feet of data center locations. In December, neighboring Prince William County approved plans to build 23 million square feet of data center space.

Source: Prince William Times

Whether or not Nvidia decides to take a bigger stake in this region, data centers are critical to the future of AI.

So Virginia is set to become more important to technological innovation than Silicon Valley.

And considering who’s currently dominating AI, it makes sense to refer to Virginia’s concentration of data centers as “Nvidia Valley.”

Our team is looking for businesses that Nvidia may try to acquire to gain a foothold in this data center capital.

We’re also looking into the utilities that will benefit as more tech companies move in.

As we discussed in April’s Water Cooler, AI requires a LOT of power. That makes local electricity provider Dominion Energy Inc. (D) a potential contender.

Just be ready to move when we zero in on the best play… because you know Nvidia won’t hesitate to stake its claim!