“Stop Publishing Politics!”

Things are very tense at Paradigm Press headquarters…

Our publisher, Matt Insley, is FURIOUS — giving a full rant during a recent editorial meeting.

Then Senior Analyst Dan Amoss replied with a rant of his own.

The first was a full-throated declaration of what Paradigm Press stands for. The second ended with a detailed example of how our philosophy can protect your money… if not help you profit.

In fact, once you hear Dan’s rant, you’ll want to check your portfolio for the problem stock he names.

But before we get to that, let’s look at our Top Stories and the Reader Forum.

Your Top Stories & Analysis of the Week:

- “Blistering!” (Daily Reckoning, Brian Maher): The financial press was ecstatic over the latest U.S. GDP numbers. But Brian explains why they’re not worth celebrating. Instead of a dry rundown of statistical irregularities, Brian uses crystal-clear examples to show why much of the touted economic growth is nothing of the sort. If you think the economy is headed for a “soft landing,” Brian’s analysis might change your mind.

- “The Next 100 Days Are CRUCIAL (Bitcoin)” (Altucher Confidential, Chris Campbell): The Bitcoin exchange-traded funds (ETFs) are off and running. And they’re setting up a streak of catalysts that could propel just about every cryptocurrency to new heights. Chris runs down the entire list for you. So make sure you have your calendar handy, because the next three months could be absolutely huge.

- ”Michelle Obama's Secret Plan to Take Back the White House” (Paradigm Press YouTube, Jim Rickards and Matt Insley): Donald Trump is on his way to securing the Republican nomination. And with Joe Biden looking weaker than ever, the Democrats may try something desperate. Jim explains how Michelle Obama could end up on the ballot — replacing Joe in a very undemocratic way. (Watch this one before YouTube takes it down!)

Remember, we publish tens to HUNDREDS of stories. The write-ups and presentations above are our TOP ones for the week. If you want to stay ahead of the pack, make sure you’re caught up now.

And if you’d like to nominate any of our stories for next week’s “Top 3,” just let me know at concierge@paradigmpressgroup.com.

The Reader Forum:

Diving into our mailbag, Don W. wants Dave Gonigam and Emily Clancy to know:

I greatly enjoy the 5 Bullets. It is always chock-full of educational and enlightening content relevant to the economy, markets, country and world at large. It’s also usually delivered with a sense of humor, making it that much more of a treat… I look forward to many more years of controversial reading that is bound to ruffle some feathers.

Thanks for the words of praise, Don. We’re pretty proud of Dave and Emily’s work, too!

It’s hard for me to get this Concierge Letter out once a week. But Dave and Emily churn out top-quality insights and analysis every day.

They certainly don’t shy away from tackling hot-button topics, either. And they always pair it with commentary that can help you become a better investor. Your letter is proof that they’re delivering, so I’m sure Dave and Emily will be thrilled to read this.

Next, after watching Jim Rickards’ latest YouTube video, member Joyce S. says:

Loved the truth and want more, thanks. Let's see how far Jim can push the boundaries of free speech and press.

I couldn’t agree more, Joyce!

As you’ve probably heard, we’re running into trouble with YouTube’s management. They’ve slapped content warnings on our videos… threatened to “de-monetize” them… and have basically let us know we’re on thin ice.

Your encouragement assures us that what we’re doing is worthwhile. I look forward to sharing this with everyone at Paradigm.

Finally for today, while we’re encouraged by compliments, I’m also standing by to clear up any misconceptions you may have.

This week, Nelson G. says:

I am getting so many different emails I don’t even know what I signed up for. Not happy at all.

Sorry to hear that, Nelson. Last week I explained how to reduce the amount of material you’re receiving from us.

You can also find a full rundown of your active subscriptions on our website.

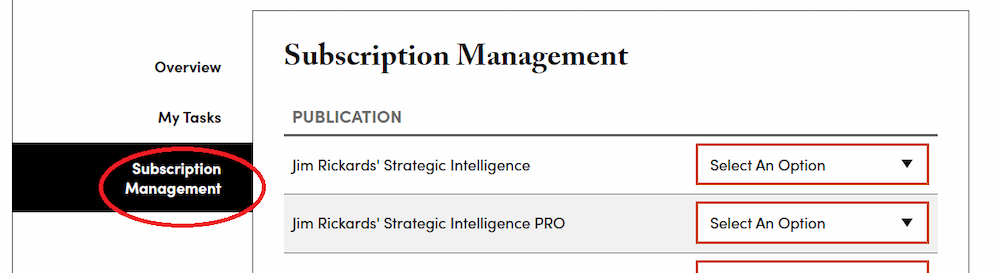

Just log in, then click on the Gear icon at the top of the screen.

That brings up all of your account information. Click on Subscription Details to see a full list of the services you’re receiving.

From there, you can click on Subscription Management. It lets you choose to unsubscribe or remove yourself from our free mailing lists.

Still having trouble? Click the Help and Contact tab!

These tools put you in complete control of your memberships… so be sure to use them!

And that wraps up this week’s Reader Forum.

Remember, your feedback is vital to our success… so please email me at concierge@paradigmpressgroup.com.

Questions? I’ll get answers! Comments? Let me hear them! Problems? I’ll try to solve them!

This is YOUR forum!

(And remember, for customer service issues, use our contact page.)

Now, here’s what’s happening around the water cooler this week…

The Water Cooler — Upcoming Events and More

As your Executive Concierge, I address a lot of complaints that our content is too political or too much “fear porn” — again and again and again.

But Matt Insley, our publisher, has a different take. In our last editorial meeting, he went on a rant about why these demands to censor ourselves stab at the very heart of Paradigm Press.

“It's all about opening your eyes to things that could really happen to your money,” he says.

“Contrarian ideas are often scary — and sometimes they come true,” he continues. “Should you hide in a pillow fort? Or should you enlighten yourself about potential threats to your wealth?”

He points out that he doesn’t always agree with every fearful prediction we make. “But if they come true, we’re screwed,” he says. “I owe it to my family to consider everything that could go wrong.”

And that feeling goes both ways. Take James Altucher’s thoughts on cryptocurrencies and artificial intelligence.

“If what he’s saying about those technologies happens, it’s a huge opportunity.”

(In fact, James will be going live later this week with exclusive insights into Apple’s incoming innovation that I mentioned last week.)

Basically, you should be open to every bit of information you receive. Even if you disagree with it, at least you’ll be forewarned.

“So we’re not going to apologize for being ‘too political,’” he adds. “If anyone wants to close their mind to the possibilities we uncover, go live in a pillow and f*ck off.”

That’s when Dan Amoss stepped in to gripe about “a hole in the narrative” of Wall Street and “mainstream financial publications like Barron’s and The Wall Street Journal.”

Dan says that more than 32 mainstream analysts track Texas Instruments Inc. (TXI), predicting its revenue and earnings every quarter.

Yet not one of them has picked up on a major red flag.

TXI’s “analog chips are used in thousands of applications like appliances, autos, and industrial equipment,” Dan says. “These are durable goods consumed mostly by middle-class households.”

But as we’ve discussed, the middle class is getting squeezed. Meanwhile, Dan tells us, TXI’s “plant operating costs have ratcheted up.”

In other words, it’s facing higher costs just as its revenue is set to plummet.

This should be obvious to anyone who even briefly scans the company’s numbers. Yet no one on Wall Street or in the financial media is talking about this.

“They’re not really doing a good service for their customers,” Dan says.

So if you’re holding Texas Instruments stock — or were considering buying it — you now have some information you wouldn’t have received otherwise.

You could also try to profit from its inevitable fall, buying put options on the stock. (In fact, Dan recently recommended such a play in The Situation Report with Jim Rickards.)

It’s all thanks to looking beyond the mainstream consensus… and not being afraid to speak out against popular opinion.