Wall Street’s Next Freakout

Investors are in a great mood after big tech companies announced blockbuster earnings.

Not even Federal Reserve Chairman Jerome Powell could dampen the enthusiasm for long.

There is some upcoming news that could cause Wall Street to freak out, however.

Maybe it’ll be just a blip… a quick pullback before the next march higher.

Or it could be the wakeup call we’ve been afraid of — undeniable proof that the U.S. economy is not OK.

Either way, if you’re planning on buying stocks in the next few weeks, you’ll want to skip a specific sector.

I’ll have all the details from our team in a minute.

But first, as always, let’s start with a look at our Top Stories and the Reader Forum.

Your Top Stories & Analysis of the Week:

- “The Apple on Your Eyes'' (Rude Awakening, Sean Ring): Apple’s latest product is a real game-changer — set to be as revolutionary as the iPhone was in 2007. Sean explores the seismic impact the new device could have in several areas… which will force competitors to really step up their games. As you’ll see, it’s set to open an entire new era of innovation — not to mention potential profits. That’s why you need to understand what makes this tech so special.

- “Last Line of Defense” (Paradigm Pressroom’s 5 Bullets, Dave Gonigam): There was a lot of big news last week, from missile attacks on U.S. naval vessels to the latest figures out of Wall Street. As always, Dave breaks it all down for you… taking you behind the headlines with insights the mainstream press leaves out. Discover the true costs of military action in the Middle East… take a closer look into the latest unemployment numbers… laugh at the latest thing being blamed for climate change… and more!

- “FED RECAP: Powell Ruins the Party” (Crisis Trader With Jim Rickards, Jim Rickards): Fed Chairman Jerome Powell was quite clear: don’t expect a rate cut in March. While investors quickly brushed off the Chairman’s words, Jim calls them “one of the most dramatic announcements the Fed has made in quite some time.” Jim shared his analysis and predictions with his Crisis Trader members — explaining why Wall Street should stop rooting for rate cuts. Considering the powerful effect the “pivot narrative” has on the markets, I decided to unlock Jim’s research so you can be prepared, too.

Remember, we publish tens to HUNDREDS of stories. The write-ups and presentations above are our TOP ones for the week — including one that had been roped off from the public. If you want to stay ahead of the pack, make sure you’re caught up now.

And if you’d like to nominate any of our stories for next week’s “Top 3,” just let me know at concierge@paradigmpressgroup.com.

The Reader Forum:

Not surprisingly, we had a lot of strong reactions to last week’s issue. And while there’s really nothing left to say about the negative comments from members, there was a lot of positive feedback, too.

Rick Z. speaks for many when he says:

It is great to hear the truth about what's going on in the world. Don't stop; keep the truth coming.

I really appreciate that, Rick! Truth is a very precious commodity these days. So our team works hard to bring it to you.

Obviously not everyone agrees with what we have to say. But few of the complaints we receive refute us — they just call us names. So it’s great to hear from so many people who understand what we’re really trying to do. I look forward to sharing this with everyone at Paradigm!

Next, from a recent survey, Strategic Intelligence member Sandra G. wants anyone sitting on the fence to know:

If you want to understand our economy and world economy and currency wars, you must listen to Jim Rickards’ Strategic Intelligence program. I am just beginning to understand things I never even heard of and am ready to start investing with his suggestions.

Thanks so much for the endorsement, Sandra! Obviously we believe everybody could benefit from Jim’s insights and analysis — not to mention his specific recommendations for playing what he sees ahead.

But it’s great to hear that get seconded by one of his members!

Finally for today, while we’re encouraged by the compliments we receive, I’m also happy to answer your questions whenever I can.

This week, Bobbie C. tells me:

I have been a member and have not done a thing yet. I need to know where or how to begin setting up an account or portfolio and from whom. I know nothing about it.

Welcome aboard, Bobbie! Sorry it’s been a rough start for you… but it shouldn’t be too hard to get you on track.

First, you should have received introductory emails to help with your first steps. Check your email’s spam box to see if they landed there by mistake. (You might need to whitelist us to prevent it from happening again.)

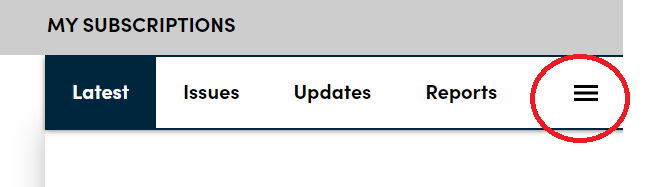

Each of our services also has a special Getting Started section on our website. Log into your service’s home page and select the Getting Started tab. You may have to click the three vertical lines on the menu bar to find it.

Also don’t forget that we have a FREE library of reports on our Wealth Desk. You’ll find complimentary guides for opening a brokerage account… buying your first stock shares… even trading stock options.

(And we’re working on a beginner’s guide to cryptocurrencies. Look for that soon!)

It should be all the information you need to start following — and profiting from — our experts’ advice.

That wraps up this week’s Reader Forum.

Remember, your feedback is vital to our success… so please email me at concierge@paradigmpressgroup.com.

Questions? I’ll get answers! Comments? Let me hear them! Problems? I’ll try to solve them!

This is YOUR forum!

(And remember, for customer service issues, use our contact page.)

Now, here’s what’s happening around the water cooler this week…

The Water Cooler — Upcoming Events and More

$100 billion in three months.

That’s the total profit Apple Inc. (AAPL), Meta Platforms Inc. (META), Alphabet Inc. (GOOG), Microsoft Inc. (MSFT) and Amazon.com Inc. (AMZN) collectively brought in last quarter.

So it’s little surprise investors are celebrating.

Of course, a big chunk of those earnings come from other businesses, which have been flush with cash.

Meta — Facebook’s parent — and Alphabet, which runs Google, rely on ad revenue. Microsoft collects the bulk of its money by providing business services.

Even Amazon.com, which most people think of as a retailer, earns a huge chunk of its cash from ads and software platforms.

In other words, the revenue they’re pulling in may not reflect what’s happening in the real economy… where people are eating through their savings and going deeper in debt.

Any undeniable signs that everyday consumers are finally cutting back will send shockwaves through Wall Street. The freakout would knock steam out of the markets.

We’ll find out when retail companies start announcing their earnings in a few weeks.

As our Dan Amoss points out, stores like Walmart Inc. (WMT) and Target Corp. (TGT) have spent the last few years reaping some limited-time benefits.

There was the free cash the U.S. government handed out during the pandemic, of course. Given the political climate, it’s unlikely you’ll start seeing extra checks from Uncle Sam anytime soon.

Today’s retailers have also benefited from the collapse of competitors.

When Sears, Kmart, JC Penny and others started shutting down stores, their customers went elsewhere — boosting revenues of other companies.

“If there’s not anybody big left to go out of business,” Dan says, “that’s going to impact sales growth.”

That means retailers are going to have to boost their bottom lines the old-fashioned way — getting more people to buy their goods.

The earnings announcements will tell us if they’ve been successful.

And the world is about to learn whether Americans are still spending freely… or if they’re finally starting to worry about their precarious financial position.

Our team is on high alert for retail earnings to come in below expectations.

We’ll also be listening closely to forward guidance — when corporate executives predict what revenue and profits will look like for the rest of the year.

Any big miss or bad outlook is likely to take the markets down a peg.

Then the question will be whether or not investors brush themselves off and start buying again.

Until we know for sure, it’s probably best to avoid the retail sector for now.

Specialty retailers like Best Buy Co. Inc. (BBY) could be especially vulnerable. People who are struggling to put food on the table are unlikely to be in the market for big-screen TVs.

And, of course, our team will share the best ways for you to take advantage of any falls we see ahead.